Why Financial Advisors Matter in Today’s Economy

In a world of market volatility and complex financial decisions, a financial advisor acts as your personal guide to navigating money matters. Whether you’re saving for retirement, planning a child’s education, or building generational wealth, their expertise transforms uncertainty into actionable strategies.

Key Takeaways:

- Advisors create customized financial plans covering investments, taxes, insurance, and debt.

- They educate clients to make informed decisions and adapt plans as life evolves.

- You don’t need to be wealthy to benefit—advisors cater to all financial stages.

What Services Do Financial Advisors Offer?

Financial advisors provide more than stock picks. Their holistic approach addresses your entire financial life:

1. Personalized Financial Planning

- Retirement Strategies: Project savings needs, optimize Social Security, and simulate worst-case scenarios to prevent outliving your money.

- Debt Management: Create payoff plans and advise on refinancing high-interest loans.

- Education Funding: Explore 529 plans, scholarships, and tax-efficient savings.

2. Investment Guidance

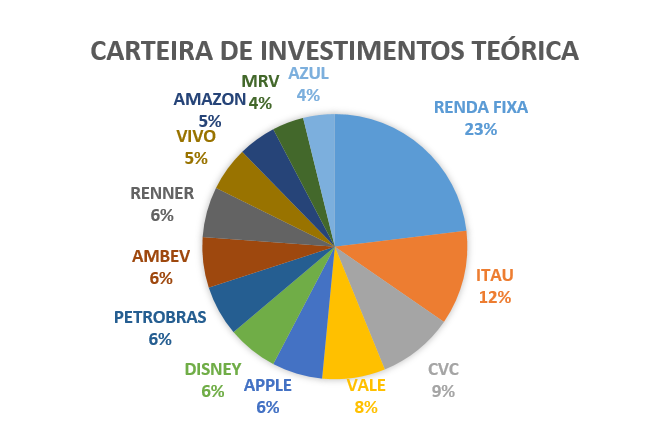

- Build portfolios aligned with your risk tolerance and goals (e.g., 70% stocks for growth vs. 45% for conservative investors).

- Explain complex concepts like tax-loss harvesting or asset allocation.

3. Insurance & Estate Planning

- Recommend term life, disability, or long-term care policies.

- Design estate plans to protect heirs and minimize taxes.

4. Tax Optimization

- Maximize deductions, strategize Roth IRA conversions, and plan for retirement tax brackets.

💡 Pro Tip: Ask advisors about their fiduciary status—those legally bound to act in your best interest often provide more transparent advice.

When Should You Hire a Financial Advisor?

You might need an advisor if:

- You’re overwhelmed by debt, investing, or budgeting.

- Life changes like marriage, divorce, or inheritance alter your finances.

- Your investments underperform or you’re holding too much cash (hello, inflation!).

- You lack an estate plan or need unbiased insurance advice.

👉 Soft CTA: Feeling stuck? Book a free consultation to explore your options.

Human vs. Robo-Advisors: Which Is Right For You?

| Feature | Human Advisor | Robo-Advisor |

|---|---|---|

| Cost | ~1% of AUM | 0.25%-0.50% of AUM |

| Personalization | High (tailored strategies) | Low (algorithm-based) |

| Complex Needs | Ideal for estates, taxes | Best for simple portfolios |

| Education & Support | 1:1 coaching | Limited to FAQs/emails |

Example: Betterment offers hybrid plans starting at 0.40% AUM, blending tech efficiency with human guidance.

How to Choose the Right Financial Advisor

- Interview Multiple Candidates: Compare fees, credentials (CFP®, CFA), and communication styles.

- Verify Credentials: Use FINRA’s BrokerCheck or the SEC’s database to check for disputes.

- Understand Fees:

- Fee-only: No commissions (fiduciary standard).

- Fee-based: Mix of fees + commissions (potential conflicts).

- Assess Compatibility: Your advisor should educate, not dictate, and align with your values.

🚀 Action Step: Download our checklist: “10 Questions to Ask Before Hiring an Advisor.”

The Cost of Financial Advice: Is It Worth It?

- Fee-Only Advisors: Charge 1% of AUM or $150-$400/hour. Ideal for transparency.

- Commission-Based: Free upfront but may push high-fee products.

- Robo-Advisors: As low as $5/month for automated investing.

Did You Know? Clients with advisors save 15% more annually for retirement than those without (2023 Financial Planning Association Study).

Final Thoughts: Your Financial Future Starts Now

A financial advisor isn’t just for the wealthy—it’s for anyone seeking clarity and confidence in their money journey. By combining education, strategy, and ongoing support, they help you turn goals into reality.

🌟 Ready to Take Control? Connect with a certified fiduciary advisor today and claim your free retirement planning guide.

Deixe um comentário